Our Income Tax Declaration Submission service for pensioners is designed to simplify the process of reporting income, deductions, and investments to the tax authorities. We understand the unique needs of pensioners and offer tailored solutions to meet their requirements.

Types:

- Basic Income Declaration: Reporting income from pension, interest, and other sources.

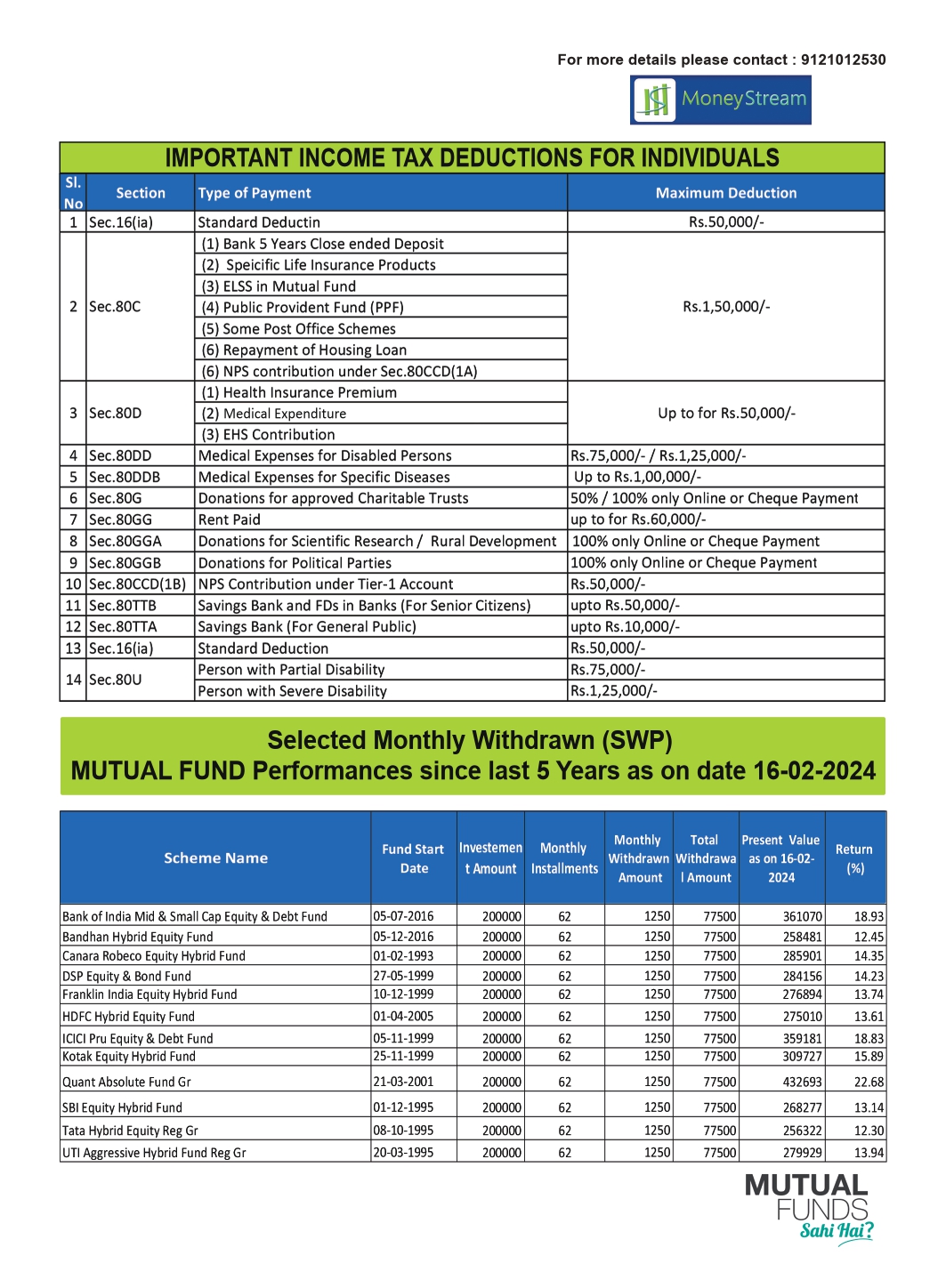

- Deductions Declaration: Claiming deductions for medical expenses, insurance premiums, and other eligible expenses.

- Investment Declaration: Providing details of investments such as mutual funds, fixed deposits, and insurance policies.

Features:

- User-Friendly Interface: Our platform offers a simple and intuitive interface for easy submission of income tax declarations.

- Guided Process: Step-by-step guidance throughout the declaration process to ensure accuracy and completeness.

- Document Upload: Secure document upload feature for submitting supporting documents such as Form 16, investment proofs, and receipts.

- Automatic Calculations: Automated calculation of tax liability based on the information provided, ensuring accuracy.

- Compliance: Compliance with income tax regulations and guidelines applicable to pensioners in India.

- Data Security: Stringent security measures to protect sensitive financial information and personal data.

- Expert Assistance: Access to expert assistance and support to resolve queries and issues related to income tax declaration submission.

With Moneystream Financial's Income Tax Declaration Submission service for pensioners, you can fulfill your tax obligations conveniently and efficiently. Our user-friendly platform, coupled with expert guidance and support, ensures a hassle-free experience. Take control of your tax declarations today with Moneystream Financial.